How This Secret Trick To Make Money to Build a ₹14.25 Crore Fund: A Simple Guide for Young Workers

This guide Secret Trick To Make Money is based on a real-life conversation between a financial advisor and Sushant, a 28-year-old IT professional. Sushant recently became the only person earning money for his family after his older brother passed away. He lives in Gurgaon and earns about ₹55,000 a month. He wants to know how to take care of his parents, his sister-in-law, and his nephew while building a secure future.

The strategy shared in the video Secret Trick To Make Money shows that even with a normal salary, you can reach a massive goal like ₹14 crore by following simple rules and being disciplined.

1. Stop Making “Safe” Investment Mistakes

Many people in India think that buying insurance policies from banks or LIC is the best way to save. Sushant was doing the same. He was paying about ₹48,000 every year into two different insurance plans. One plan promised to give him ₹4.5 lakh after 20 years, and the other promised ₹10 lakh.

The advisor pointed out that this is a bad deal. These returns are very low and won’t even keep up with rising prices (inflation). Because Sushant is young (28 years old) and has a steady job, he should be taking more risks to get better returns. The advice was to stop these policies immediately, even if the money already paid (about ₹1.5 lakh) is lost. This is called a “sunk cost”—the money is gone, but staying in a bad plan will only lose you more money in the long run.

2. Secret Trick To Make Money: Set Up a Real Safety Net

Before you start investing for crores, you must protect your family. The video suggests three steps for safety:

Term Life Insurance: Buy a “Term Insurance” policy for ₹1 Crore. This is a pure insurance plan with no “money back” feature, which makes it very cheap. At 28, it costs only about ₹17,000 to ₹20,000 a year. This ensures that if something happens to you, your family gets ₹1 crore.

Emergency Fund: Don’t keep all your savings in your spending account because you will spend it. Keep about ₹5,000 in your bank for daily needs. Put around ₹40,000 into a Fixed Deposit (FD). Only touch this FD if there is a real emergency.

Personal Health Insurance: Don’t rely only on your company’s health insurance. If you quit your job, you lose that cover. Get a small personal plan for yourself and your family.

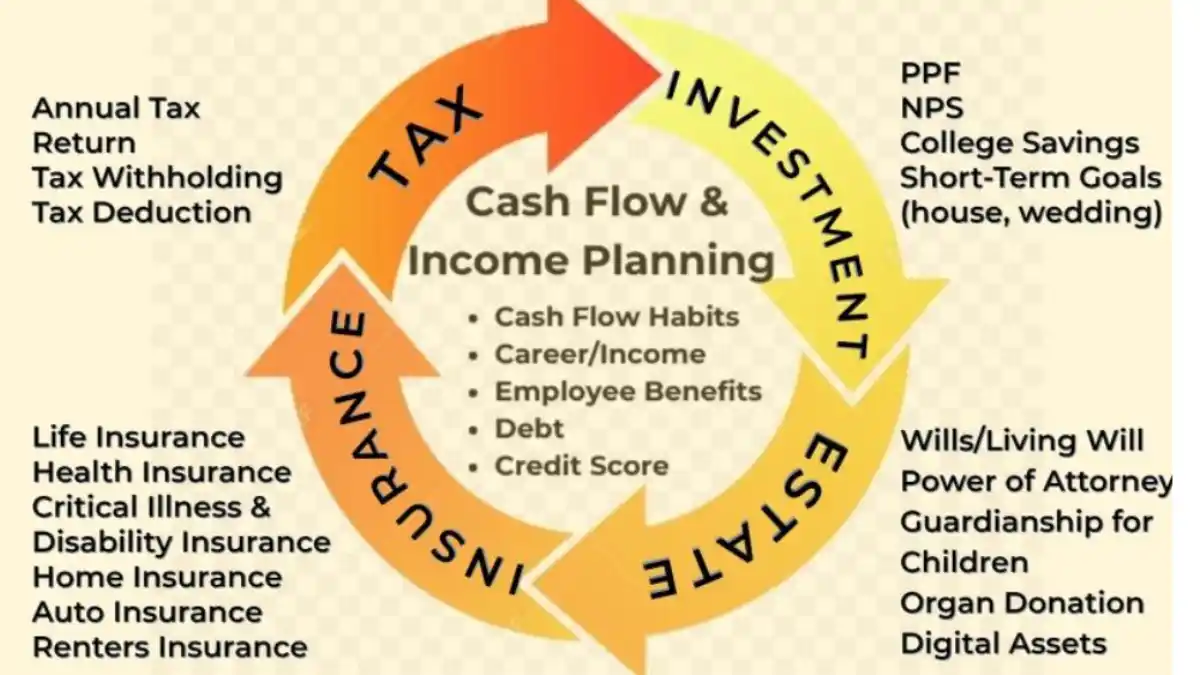

3. Let Your PF Handle Your Retirement

The man Sushant has about ₹5,500 deducted from his salary every month for his Provident Fund (PF). The advisor calculated that if this continues for 30 years and increases by just 5% every year as his salary grows, it will become ₹1.26 Crore. This means he doesn’t need to worry about other pension schemes or “safe” retirement plans. The PF is already doing the job.

4. The Three-Step Investment Plan to ₹14.25 Crore

The core of the Secret Trick To Make Money strategy is to invest ₹15,000 every month into three different types of Mutual Funds. You must increase this ₹15,000 by 5% every year (e.g., next year you invest ₹15,750). Here is the breakdown:

- ₹8,000 in a Nifty 50 Index Fund: This fund invests in the top 50 companies in India. It is expected to give a 13% return. In 30 years, this will grow to ₹5.15 Crore.

- ₹3,500 in a Mid Cap Index Fund: This invests in medium-sized companies. It is expected to give a 15% return. In 30 years, this will grow to ₹4.04 Crore.

- ₹3,500 in a Small Cap Index Fund: This invests in smaller, faster-growing companies. It is expected to give an 18% return. In 30 years, this will grow to ₹4.75 Crore.

When you add these three amounts to the ₹1.26 crore from the PF, the total comes to ₹14.25 Crore.

5. Secret Trick To Make Money: Use the “EMI Mindset”

The hardest part isn’t the math; it’s the discipline. The advisor suggests treating your SIP (Systematic Investment Plan) like a bank loan (EMI). When you have a car or house loan, you make sure to pay the bank on time because you are scared of the consequences. You should have that same “fear” for your investments.

The hardest part isn’t the math; it’s the discipline. The advisor suggests treating your SIP (Systematic Investment Plan) like a bank loan (EMI). When you have a car or house loan, you make sure to pay the bank on time because you are scared of the consequences. You should have that same “fear” for your investments.

Think This Secret Trick To Make Money as a payment to your future self. If you don’t pay your SIP today, you are stealing from the 58-year-old version of yourself who will need that Secret Trick To Make Money. Another trick is to keep your bank balance very low. If you see extra money in your account, you will likely spend it on things you don’t need. If you invest it immediately, you learn to live on what is left.

6. It’s About Time, Not Just Money

The advisor shared a personal lesson: don’t think that just sending money home is enough. For parents who have lost a child, money cannot fill that gap. They need your time, respect, and emotional support. As parents get older, they become more like children—they want you to visit, listen to them, and be present.

Summary of the Strategy

- Cancel low-return insurance policies.

- Get a ₹1 Crore Term Insurance policy for family protection.

- Keep an Emergency Fund of ₹40,000 in an FD.

- Start three SIPs totaling ₹15,000/month (Nifty 50, Mid Cap, Small Cap).

- Increase your investment by 5% every year.

- Wait 30 years.

The math shows that using this Secret Trick To Make Money reaching ₹14 crore is possible for a regular professional. You don’t need to be a genius; you just need to start this Secret Trick To Make Money early, stay consistent, and avoid safe traps that don’t grow your wealth.

Recent Posts: