According to the latest notification from the income tax pan card department, it is now mandatory for every individual to complete the Aadhaar card pan card link process immediately. If you haven’t done this yet, you are running out of time as the aadhaar pan linking deadline is set for December 31, 2025.

Failure to meet this deadline will result in your PAN becoming “inoperative” starting from the next year. An inoperative pan card status means you cannot file your income tax returns, claim pending refunds, or even open a new bank account. Therefore, understanding the aadhaar pan linking process is vital for every taxpayer.

Why the Aadhaar card pan card link is Mandatory

The government has made pan to aadhaar link compulsory to prevent tax evasion and identify individuals holding multiple PAN cards under a single identity. By ensuring you link pan with aadhaar, the tax department can create a transparent and linked financial profile for every citizen. This synchronization is a key step toward a more organized and digital tax ecosystem.

If you delay the aadhaar to pan link beyond the deadline, your financial life could become difficult. Not only will you face higher TDS (Tax Deducted at Source), but you may also be unable to complete high-value transactions, such as buying property or investing in the stock market. Taking care of your pan link aadhar status today will save you from legal and financial hurdles later.

Understanding the Rs 1,000 Late Fee

It is important to note that the window for free linking has closed. Taxpayers must now pay a late fee of Rs 1,000 before they can link aadhaar status with their PAN. This fee must be paid through the e-filing portal. However, there is a small exemption: PAN holders who received their cards after October 1, 2024, using an Aadhaar enrollment ID, are allowed to link the two for free until December 31, 2025.

How to Link Aadhaar card pan card link (English & Hindi)

Follow this simple official procedure to update your aadhaar pan link status:

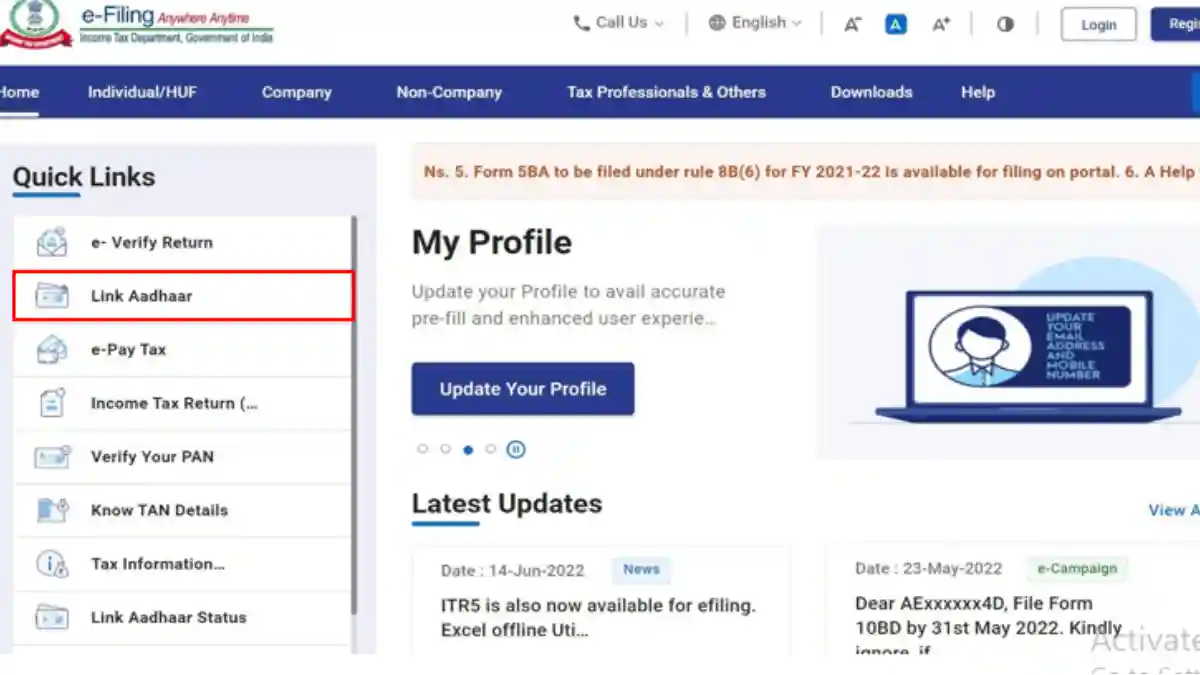

Step 1: Visit www.incometax.gov.in.

(Income Tax ki official website par jayein.)

Step 2: Click on Link Aadhaar under Quick Links.

(Quick Links mein Link Aadhaar par click karein.)

Step 3: Enter your PAN and Aadhaar numbers.

(Apna PAN aur Aadhaar number bharein.)

Step 4: Click Validate to verify your fee payment.

(‘Validate’ par click karke payment verify karein.)

Step 5: Submit the OTP received on your mobile.

(Mobile par aaya OTP enter karke submit karein.)

Checking Your Aadhaar card pan card link Status

To verify if your documents are already updated, use the Link Aadhaar Status tool on the e-filing portal. By entering your details, you can instantly see your Aadhaar card pan card link status. If it says “PAN is already linked to Aadhaar,” no further action is required.

Also Read

• New Honda Bikes Launching in 2026

• Redmi Note 15 Pro 5G Launch Details

FAQs

Deadline for Aadhaar Card pan card linking?

December 31, 2025.

Is there a penalty?

Yes, Rs 1,000 late fee is mandatory.

Aadhaar link last date 31 December

In conclusion, keeping your Aadhaar card pan card link updated is the only way to ensure your financial transactions remain uninterrupted. While the Rs 1,000 penalty is mandatory, it is a small price compared to the complications of an inoperative PAN. Make sure to check your pan card status today and complete the Aadhaar pan link process before the aadhaar pan linking deadline of December 31.

Aadhaar card pan card link is mandatory by December 31, 2025. Failing to do so will make your PAN inoperative, blocking tax filing and banking services. A late fee of Rs 1,000 applies.